Your time and convenience are important to us. There’s no need to rush to the branch to deposit your checks. Mobile Deposit is fast, convenient and secure.

Login to our Mobile Banking app to get started today.

.png?width=35&height=35) |

Login to our Mobile Banking app. Enter your CU Mobile ID and Password, then click Sign In.

|

|

.png?width=35&height=35) |

From the Accounts screen, click the Quick Links Button.

|

.png?width=35&height=35) |

Click Mobile Deposit.

|

.png?width=35&height=35) |

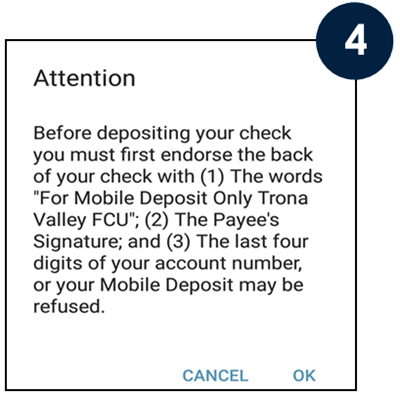

A pop-up appears with instructions for proper endorsement of your Mobile Deposit. Click OK.

|

.png?width=35&height=35) |

Choose the account to deposit into. Enter the Amount of the check. Add a Memo (Optional). Take a picture of the Check Front and Check Back, then click Submit.

|

|

Verify your deposit information has been entered correctly, then click Confirm.

|

|

The Pending message will appear, indicating your deposit has been received. Click Another Deposit or Back to Accounts. If your mobile deposit has failed, refer to item 3 under How to Check the Status or the Troubleshooting Tips.

|

How to Check the Status of your Mobile Deposit

.png?width=35&height=35) |

To check your deposit status, from the Mobile Deposit screen, click History.

|

|

.png?width=35&height=35) |

After your Mobile Deposit has been reviewed, you will see the status change to Success OR Failed.

Deposits with a Failed status may need to be resubmitted. Reasons your deposit may fail:

- Cannot read check. You may see this failed message if your check image was not within the image frames.

- Amount entered did not match. You may see this failed message if the amount you entered did not match the amount of the check detected by the system.

- Poor image quality or no endorsement. You may see this failed message if the back of your check is not properly endorsed.

|

|

.png?width=35&height=35) |

Your deposit may also have a Failed status (Rejected Item) for one of the following reasons. You will be notified through the mobile messaging system of the reason for the rejection.

- Duplicate item

- Image quality issue

- Foreign check

- Non-negotiable item

- Ineligible items such as Savings Bond, Money Order, and Traveler’s Cheques

- Missing Information on the check; including the amount of the check, Payee’s name, signature of the drawer (maker), date, check number, pre-printed information identifying the drawer and the paying financial institution, the MICR line.

- Endorsement missing

- Not an authorized user

|

|

How to View Check Images and Transaction History

.png?width=35&height=35) |

To view the Mobile Deposit check image, from the Mobile Deposit screen, click History.

|

.png?width=35&height=35) |

Click the item to review the deposit details and view the front and back of the check.

|

.png?width=35&height=35) |

Transaction History—Your approved deposit will display in your transaction history with information on any holds placed on the deposit.

|

Troubleshooting Tips

Check Image Requirements

Images of the front and back of the check must be legible and include the following:

- Amount of the Check (both written and numeric)

- Payee(s)

- Signature of the drawer (maker)

- Date

- Check number

- Information identifying the drawer and the paying financial institution that is preprinted on the Check including the MICR line

- All other information placed on the Check prior to the time of Check image capture (such as any required identification written on the front of the Check and any endorsement applied to the back of the Check)

Ineligible Check Images Include:

- Checks that have been altered

- Checks that are drawn on your accounts

- Checks drawn on banks located outside the United States

- Checks that are illegible or incomplete

- Checks that are images of checks previously converted to Substitute Checks

- Checks that have been previously presented for deposit (duplicate item)

- Checks that are stamped with a "non-negotiable" watermark

- Checks that are "stale dated" or "postdated"

- Savings Bonds

- Checks that are made payable to multiple payees in which all payees are not owners of the Account

- Checks that are third party items (items not originally made payable to you)